India’s Consumer Price Index (CPI) based inflation rose to 7.44% from 4.87% in July, according to the latest report of the Ministry of Statistics and Programme Implementation. It is a big jump and considerably higher than last month. Team IndiaInFacts have analysed the data. let’s find out how CPI inflation has fared for July 2023 in your state.

In July 2022, the Consumer Price Index was recorded at 6.72 percent. The rise in CPI-based inflation is due to food inflation, which came in at 11.51 percent. The food inflation was 4.55 percent in June and it was 6.69 percent in July 2022.

The rural inflation stood at 7.63 percent in July. Urban inflation in the same month stands at 7.2 percent.

The food inflation for rural India was 11.04 percent and urban was 12.32, according to the official data. CPI data has been highest since April 2022 when it was reported at 7.79%.

Food inflations hits double digit, CPI rises to 7.44 %

The Weather God has not been kind to this year. Lots of unseasonal rains coupled with extremely heavy downpour has affected the vegetable crops all over India. On year on year basis our vegetable component of food Inflations has escalated up to 37 .34% . Spices (21.63%), Pulses and Products (13.27 %) and Cereals and products (13.04%) are other significant contributors of Food inflation which has shown double digit spike.

'

Edible Oil prices has come down significantly in last few months. Oil & Fats has registered a negative growth of 16.80 %. On June 2, 2023,Government convenes 2nd meeting with leading Oil producers Association to discuss further cut in edible oil prices amidst fall in global prices. In the meeting Government has mentioned that they have observed that Industry is not passing the price drop benefits to the end consumer expeditiously.

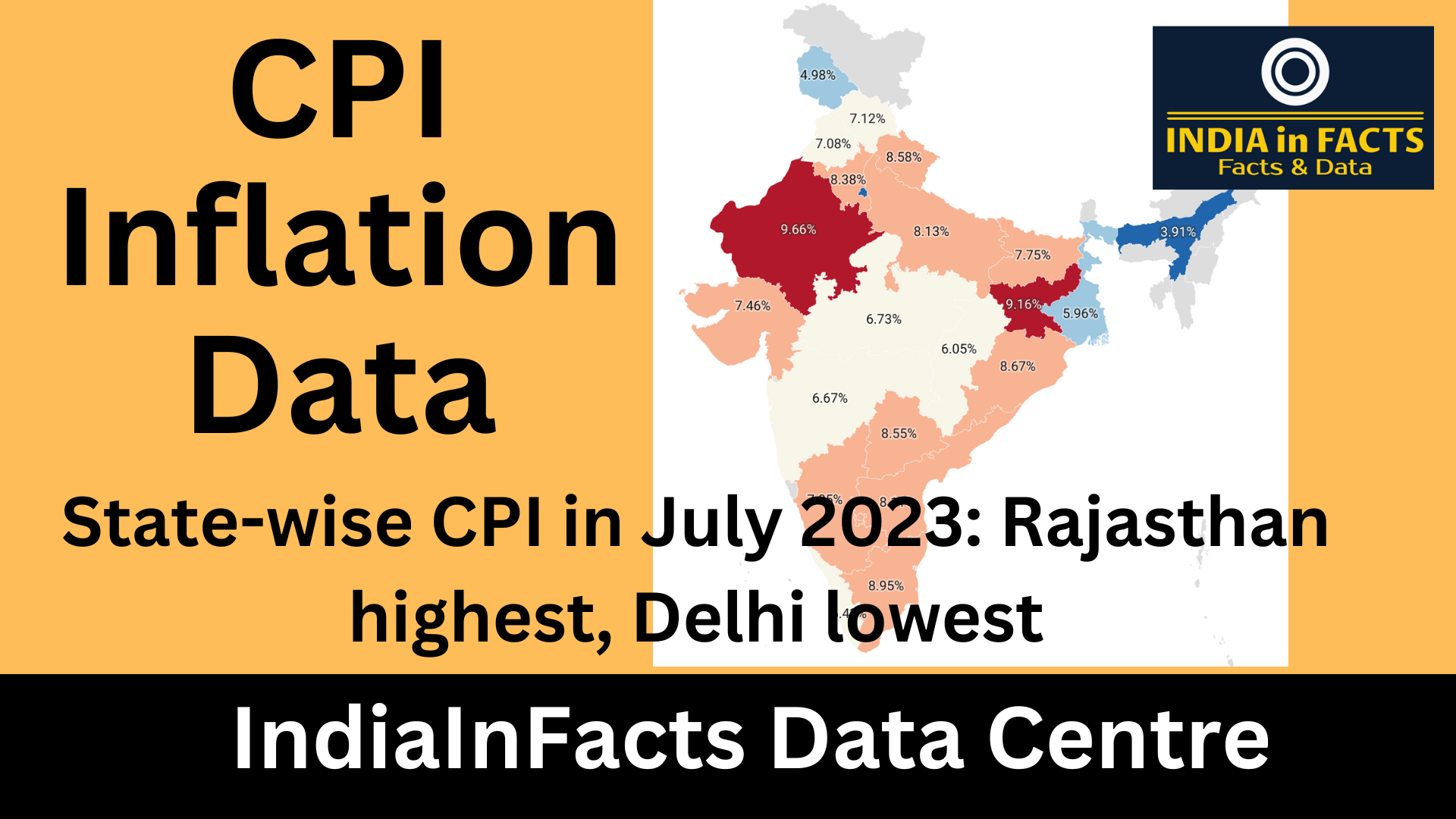

State-wise CPI in July 2023: Rajasthan highest, Delhi lowest

Delhi has registered lowest inflation

Reserve Bank maintains Status quo for 3rd time

Just few days ago, on 10th of August, 2023, RBI Governor Shakti Kanta Das has mentioned that they have revised CPI inflation forecast for FY2023-24 to 5.4 % from 5.1%. RBI Governor has mentioned, “While the vegetable price shock may reverse quickly, possible El Nino weather conditions, along with global food prices need to be watched closely, against the backdrop of skewed Southwest Monsoon.”

High Interest cycle to continue for some more months

Ashima Goyal, another external member, said inflation is falling as expected, and it is important to ensure the real repo rate does not rise too high and damage the economic cycle.

This is a topic close to my heart cheers, where are your contact details though?

Do you mind if I quote a few of your articles as long as I provide credit and sources back to your blog? My website is in the very same niche as yours and my users would really benefit from a lot of the information you provide here. Please let me know if this ok with you. Thanks a lot!

An added important component is that if you are a senior, travel insurance for pensioners is something you should make sure you really contemplate. The more mature you are, the harder at risk you are for getting something bad happen to you while in foreign countries. If you are never covered by some comprehensive insurance plan, you could have quite a few serious complications. Thanks for sharing your suggestions on this blog site.

You have brought up a very superb details , thanks for the post.

Hello! I’m at work browsing your blog from my new iphone! Just wanted to say I love reading your blog and look forward to all your posts! Carry on the fantastic work!

Hi, i think that i saw you visited my weblog thus i came to “return the favor”.I am attempting to find things to improve my website!I suppose its ok to use some of your ideas!!

Very good blog! Do you have any tips for aspiring writers? I’m hoping to start my own website soon but I’m a little lost on everything. Would you suggest starting with a free platform like WordPress or go for a paid option? There are so many choices out there that I’m totally confused .. Any suggestions? Cheers!